Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website

RBNZ Maintains Official Cash Rate at 5.5%: A Detail Review

RBNZ’s Stance on Monetary Policy

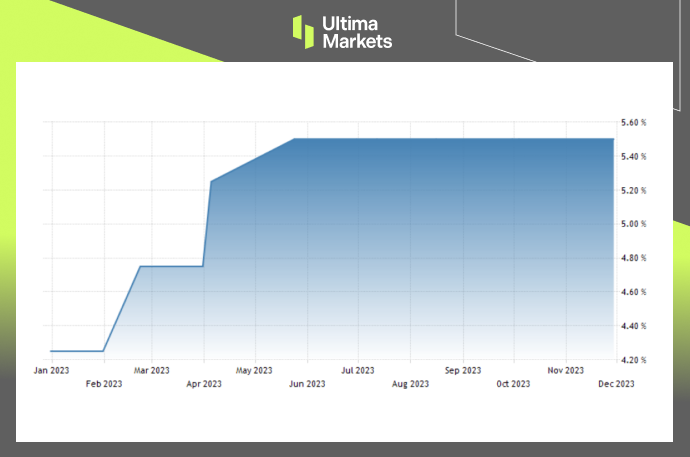

The Reserve Bank of New Zealand (RBNZ) has upheld its Official Cash Rate (OCR) at 5.5%, a decision expected by market analysts. This marks the fourth consecutive meeting where the central bank has chosen to maintain the current rate, showcasing a deliberate approach to monetary policy.

Inflation and Economic Indicators

A key consideration behind the RBNZ’s decision is the state of inflation and the job market. The central bank, cognizant of declining inflation rates, appears poised to sustain its current policy stance. However, the lingering question revolves around whether the RBNZ will continue its assertive communication on rates or shift to a more nuanced approach.

Recent data trends suggest a potential inflection point in the RBNZ’s tightening cycle. Despite the rhetoric on maintaining high-interest rates, indications point to a moderation in their hawkish stance. This delicate balance between economic indicators and central bank messaging adds an element of uncertainty to the future direction of monetary policy in New Zealand.

(New Zealand Interest Rate, RBNZ)

The New Zealand Dollar and Market Dynamics

Against the backdrop of a weakened US dollar, the New Zealand dollar has demonstrated strength, nearing $0.61—a level not seen since early August. The recent formation of a new center-right administration has further bolstered market confidence, contributing to the positive trajectory of the New Zealand dollar.

(NZDUSD One-year Chart)

Financial Market Response

Examining the financial market response to the RBNZ’s decision, platforms like Ultima Markets, FXStreet, NASDAQ, Bloomberg, and The Edge Malaysia have provided real-time coverage and analysis. Traders and investors are closely monitoring the central bank’s actions and accompanying statements, seeking insights into future market dynamics.

Bottom Line

In conclusion, the RBNZ’s decision to maintain the Official Cash Rate at 5.5% underscores the delicate balance between economic indicators and central bank communication. The nuanced shifts in their approach will undoubtedly shape New Zealand’s economic landscape in the coming months.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4