US Treasuries and Anticipated Rate Cuts Cause Frenzy

TOPICSEvaluating the Impact: U.S. Treasury Bond Yields Amid Rate Cut Predictions

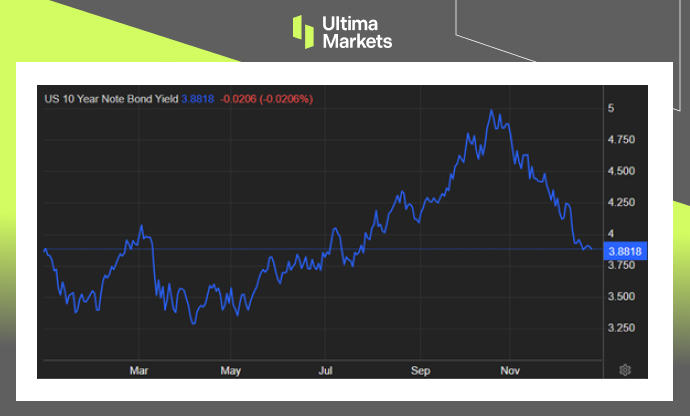

Amidst evolving market dynamics, the U.S. 10-year treasury bond yield has witnessed a significant shift, settling at 3.88% post the Christmas holiday.

This recent descent brings the yield in close proximity to its lowest levels since late July, painting a picture of cautious investor sentiment.

In this article, we delve into the factors influencing this decline and explore the expectations of pronounced interest rate reductions in the forthcoming year.

Understanding the Movement

The figures from the previous Friday revealed a 0.1% decrease in the US PCE price index for November. This unexpected downturn, the first since February 2022, deviated from the market’s anticipation of a flat reading. The implications of this shift are now steering market sentiments towards a 75% probability of a 25-basis-point rate cut by the Federal Reserve in March.

Analyzing the Numbers

As investors assess the landscape, the CME FedWatch tool provides valuable insights. The tool currently projects an outlook of over 150 basis points in total rate cuts for the upcoming year. This anticipation is becoming a pivotal factor in shaping investment strategies and decisions.

Key Players in the Market

Treasury yields fall as traders assess prospects of future rates

Traders are carefully scrutinizing future rate scenarios, contributing to a slight downturn in Treasury yields. This video from CNBC sheds light on the climb in U.S. Treasury yields driven by predictions of Fed rate cuts.

Treasuries 10-Year Yield Falls Below 4% as Fed Signals End

Bloomberg’s report on the yield dropping below 4% for the first time since August, influenced by the Federal Reserve signaling a potential halt to interest rate hikes.

U.S. Treasury yields: investors digest interest rate outlook

Investors are digesting the Federal Reserve’s outlook on interest rates, resulting in Treasury yields reaching multi-month lows. This CNBC article explores the implications of the Fed’s indication of rate cuts.

Treasury Auctions Lure Buyers as Fed Rate Cut Wagers Build

Buyers are flocking to U.S. Treasury auctions, seeking to secure higher yields amidst the anticipation of an aggressive path of Federal Reserve interest-rate cuts. Bloomberg’s insights delve into this intriguing market trend.

Bond investors may be betting too aggressively on 2024

BlackRock suggests that bond investors might be placing overly aggressive bets on rate cuts in 2024. Reuters analyzes the expectations of a 75 to 100 basis point rate cut and its potential impact on certain parts of the Treasury curve.

U.S. bond yields almost fully priced in for 2024 rate cuts

According to a Reuters poll, U.S. Treasury yields are expected to decline, albeit less than the previous seven weeks. The article details the projections made by bond strategists.

Treasury Yields Invert as Investors Weigh Risk of Recession

As the Federal Reserve signals potential interest rate cuts in 2024, U.S. Bank explores the uncommon dynamics leading to the inversion of Treasury yields, raising concerns about a possible recession.

Fed signals rate cuts in 2024, BP former CEO to forfeit up

The Financial Times reports on the sinking of U.S. Treasury yields after the Federal Reserve releases its rate cut forecast. The article covers the implications of this development on Treasury yields and stock markets.

Frequently Asked Questions

Q1: What is causing the decline in U.S. Treasury yields?

The decline in U.S. Treasury yields is primarily attributed to the anticipation of more substantial interest rate cuts in the coming year. Factors such as subdued inflation data and market expectations of a rate cut by the Federal Reserve contribute to this trend.

Q2: How are investors reacting to the prospect of rate cuts?

Investors are responding by reassessing their portfolios and adjusting their strategies to navigate the evolving interest rate landscape. The recent increase in demand during Treasury auctions reflects their inclination to lock in higher yields amidst the possibility of aggressive rate cuts.

Q3: Where can I find real-time information on the U.S. 10 Year Treasury Note?

Q4: How is the CME FedWatch tool influencing market sentiments?

The CME FedWatch tool is currently projecting an outlook of over 150 basis points in total rate cuts for the upcoming year, influencing investor expectations and decisions.

Q5: What is the current 10-year treasury rate?

The 10 Year Treasury Rate stands at 3.89%.

Bottom Line

As the U.S. Treasury bond yields navigate through a landscape of rate cut predictions, investors are strategically positioning themselves to adapt to potential changes. The Federal Reserve’s signals and market dynamics will continue to play a pivotal role in shaping the trajectory of U.S. Treasury yields in the upcoming year.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4