Bleak Economic Figures Push Hang Seng to Year Low

The Hong Kong stock market faced a challenging day on December 8th, as the Hang Seng Index experienced a decline of about 0.1%, shedding 11.52 points to finish at 16,334.38.

This marked the second consecutive session of losses for the index, with a more significant weekly plunge of nearly 3% over three straight losing sessions.

Sectors such as basic materials, healthcare, technology, and consumer cyclicals witnessed substantial losses, driven by mounting concerns over China’s economic trajectory.

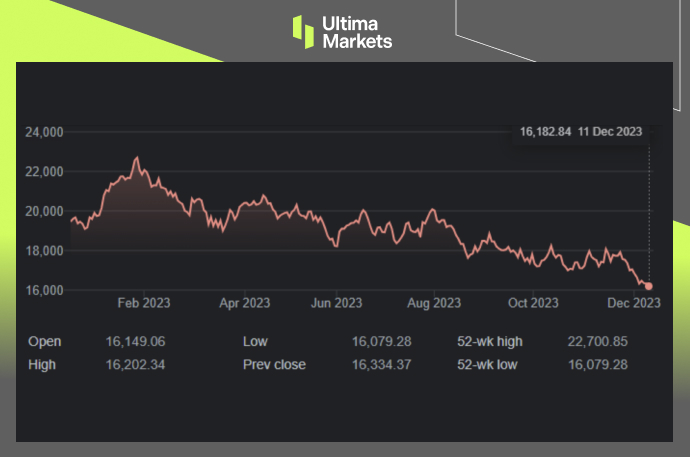

Hang Seng Index in a Downtrend

The Hang Seng Index, a major indicator of Hong Kong’s stock market health, has been on a downtrend, reflecting the prevailing economic challenges. The Hang Seng Index retreated 0.7% to 16,345.89 on Thursday, approaching its lowest point since mid-November last year. The Tech Index also witnessed a drop, contributing to the overall market decline.

(Hang Seng Index One-year Chart)

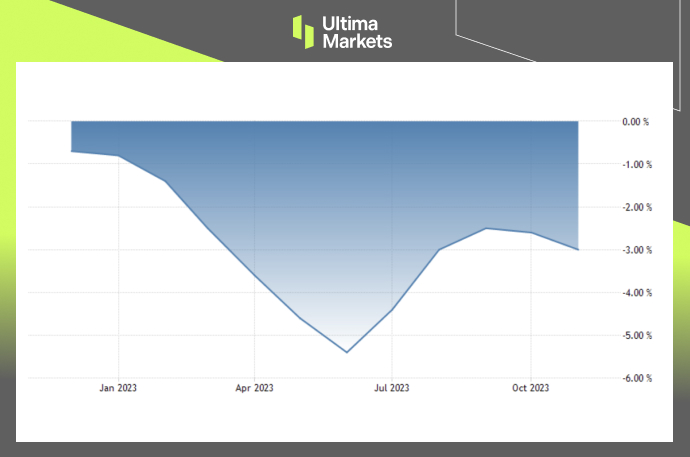

China’s Producer Price Index (PPI) Woes

Adding to the economic woes, China’s Producer Price Index (PPI) faced steep declines, highlighting persistent deflationary pressures. In November 2023, the PPI fell by 3.0% year-over-year, marking the 14th consecutive month of producer deflation.

This rapid decline surpassed October’s 2.6% fall and exceeded market expectations. The steepest producer deflation since August underscores challenges such as local government debt, a property sector crisis, and broader economic headwinds affecting both domestic and international demand.

(PPI, National Bureau of Statistics of China)

Impact on Hong Kong Stocks

The impact on Hong Kong stocks is evident as reflected in reports like Hong Kong Stocks in Longest Losing Streak in Three Weeks, which details the Hang Seng Index’s 0.3% drop to 17,511.29, capping a three-day spell of falls.

Market Sentiment and Declines

Market sentiment is crucial in these challenging times, and the market declines have been influenced by the decline in China’s consumer and producer prices. The Hang Seng Index lost 0.8%, emphasizing the current sentiment dampening over economic indicators.

Frequently Asked Questions

Q: What is the current state of the Hang Seng Index?

A: As of the latest reports, the Hang Seng Index is experiencing a downward trend, reaching close to its lowest point since mid-November last year.

Q: What is driving the declines in Hong Kong stocks?

A: Multiple factors, including concerns over China’s economic performance, steep declines in China’s Producer Price Index, and general market sentiment, are contributing to the declines.

Q: How are technology stocks performing in this scenario?

A: Technology stocks, as indicated by the Tech Index, have also witnessed a drop, contributing to the overall market decline.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4