RBNZ’s Stance on Monetary Policy

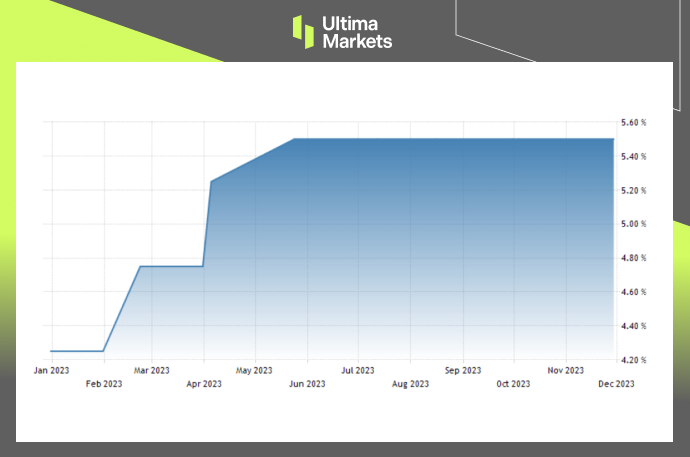

The Reserve Bank of New Zealand (RBNZ) has upheld its Official Cash Rate (OCR) at 5.5%, a decision expected by market analysts. This marks the fourth consecutive meeting where the central bank has chosen to maintain the current rate, showcasing a deliberate approach to monetary policy.

Inflation and Economic Indicators

A key consideration behind the RBNZ’s decision is the state of inflation and the job market. The central bank, cognizant of declining inflation rates, appears poised to sustain its current policy stance. However, the lingering question revolves around whether the RBNZ will continue its assertive communication on rates or shift to a more nuanced approach.

Recent data trends suggest a potential inflection point in the RBNZ’s tightening cycle. Despite the rhetoric on maintaining high-interest rates, indications point to a moderation in their hawkish stance. This delicate balance between economic indicators and central bank messaging adds an element of uncertainty to the future direction of monetary policy in New Zealand.

(New Zealand Interest Rate, RBNZ)

The New Zealand Dollar and Market Dynamics

Against the backdrop of a weakened US dollar, the New Zealand dollar has demonstrated strength, nearing $0.61—a level not seen since early August. The recent formation of a new center-right administration has further bolstered market confidence, contributing to the positive trajectory of the New Zealand dollar.

(NZDUSD One-year Chart)

Financial Market Response

Examining the financial market response to the RBNZ’s decision, platforms like Ultima Markets, FXStreet, NASDAQ, Bloomberg, and The Edge Malaysia have provided real-time coverage and analysis. Traders and investors are closely monitoring the central bank’s actions and accompanying statements, seeking insights into future market dynamics.

Bottom Line

In conclusion, the RBNZ’s decision to maintain the Official Cash Rate at 5.5% underscores the delicate balance between economic indicators and central bank communication. The nuanced shifts in their approach will undoubtedly shape New Zealand’s economic landscape in the coming months.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4