The Bright Outlook for US Stocks: A Market Analysis

In November 2023, the US stock market witnessed a significant upswing, reinforcing expectations of an end to the era of rate hikes.

The Dow Jones index soared by more than 560 points on November 2nd, marking its most remarkable daily gain since June. Simultaneously, the S&P recorded a 1.89% surge, its most substantial single-day increase since April. The Nasdaq also celebrated a robust performance, closing 2.36% higher, its best showing since July.

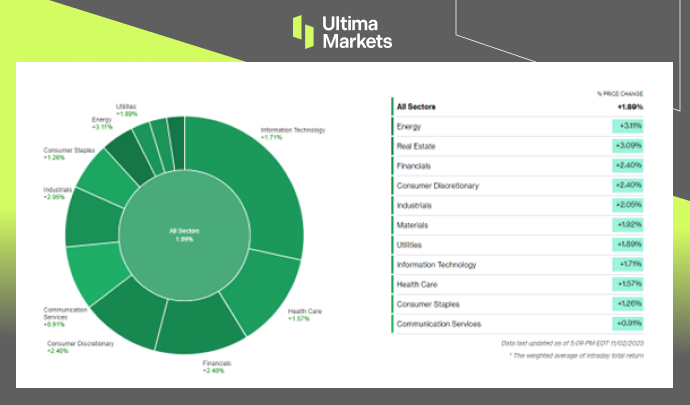

This impressive market rally was underpinned by gains in the energy and real estate sectors, both of which secured advances exceeding 3.0%. These substantial gains contributed to all eleven S&P sectors concluding the session on a positive note.

US Stocks Saw Strong Buying Across Sectors

The momentum behind these stock market surges is closely tied to growing expectations regarding the Federal Reserve’s future monetary policy.

As this sentiment gains traction, investors and market participants are becoming increasingly confident that the central bank is nearing the completion of its rate-hiking efforts.

Additionally, the benchmark US 10-year yield fell to its lowest level in three weeks, reaching 4.65%. This decline further signifies the market’s anticipation of a more accommodative monetary stance

Robust Sector Performance

One of the most notable aspects of this remarkable stock market rally is the broad-based nature of the gains. Notably, the energy and real estate sectors exhibited exceptional strength, each securing advances exceeding 3.0%.

These gains underscore the market’s confidence in the economic outlook and support the view that the recovery remains firmly on track.

(Sector Performance, Bloomberg)

Signs of a Weakening Job Market

While the stock market flourishes, the job market faces challenges, which require close scrutiny:

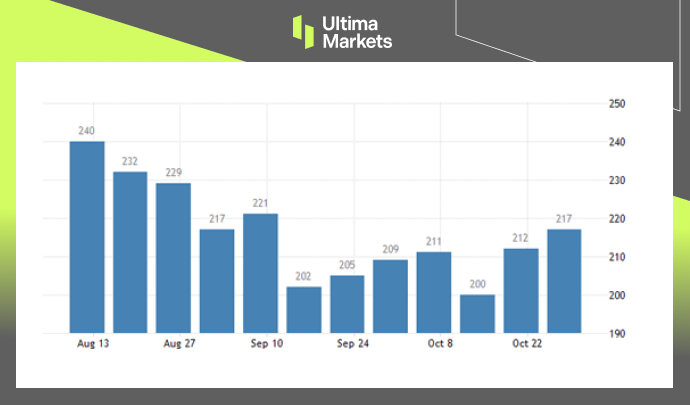

- Unemployment Claims: The number of Americans applying for unemployment benefits increased to 217,000, surpassing market estimates. This indicates that unemployed individuals are encountering difficulties in finding employment.

- Continuing Jobless Claims: Continuing claims rose to 1,818,000, exceeding market expectations. These figures align with signals from the Federal Reserve, suggesting that labor market conditions are softening.

- Nonfarm Payrolls: All eyes are now on the upcoming nonfarm payrolls report, with economists predicting an increase of 180,000 jobs in October, following a substantial gain in September. This report will provide crucial insights into the job market’s health.

(Initial Jobless Claims, United States Department of Labor)

Bottom Line

In conclusion, the US stock market’s recent surge is a significant development with far-reaching implications. As the market regains strength, it underlines the growing confidence in a more accommodative monetary policy by the Federal Reserve.

However, it’s vital to balance this optimism with the challenges in the job market, as signs of weakness in unemployment claims and continuing claims signal potential hurdles in the economic recovery.

The interplay between these factors will undoubtedly shape the trajectory of the US economy in the months to come.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4