You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

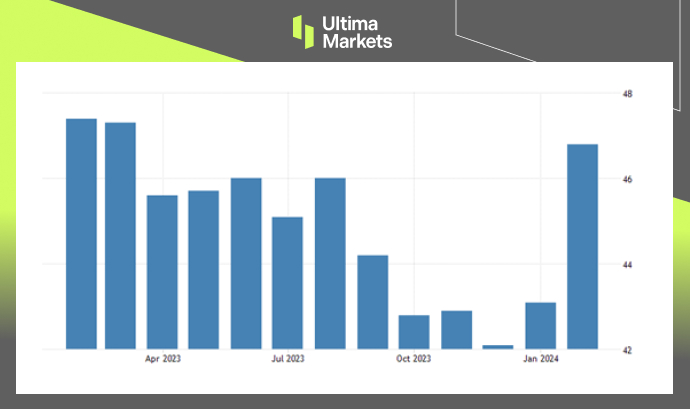

The HCOB France Manufacturing PMI increased to 46.8 in February 2024 from 43.1 in January, which was higher than market expectations of 43.5. Although the PMI remained below the 50 mark that indicating contraction for the 13th straight month, the February reading was the highest since March 2023.

The increase was largely attributable to improvements in the new orders index, which rose over seven points, significantly reducing the decline in production. Some manufacturers reported higher output as they worked to restock inventory. Additionally, the pace of job cuts in manufacturing moderated. Regarding prices, input costs continued to decrease, suggesting supply chain disruptions have not pushed up production expenses thus far. Looking ahead, French manufacturers’ expectations for the next 12 months were broadly neutral.

(France Manufacturing PMI, S&P Global)

The CAC 40 saw an increase of 0.7%, wrapping up at 7,966 last Friday, marking a new all-time high and exceeding the performance of its European counterparts due to positive corporate updates.

The industrial gas titan, Air Liquide, achieved a record high, leading to the surge in Paris with a hike of 2.2% following its annual results for 2023. The firm doubled its aim for the operating margin for 2022 to 2025 and increased the suggested dividend by 8.5% to 3.20 euros.

Capegemini, Michelin, and Stellantis also reported notable progress, with gains of 1.99%, 1.76%, and 1.57%. Simultaneously, traders will keep an eye out for fresh corporate updates and recent comments from monetary policymakers at the Fed and ECB, showing prudence ahead of probable interest rate reductions. The CAC 40 saw a weekly advancement of 2.8%, followed by US equities’ advance.

(CAC 40 Index Yearly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4