You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Geopolitical Turmoil Fuels Oil Price Surge

Amidst the volatile landscape of the global oil market, October 2023 stands out as a month of upheaval and uncertainty, with crude oil prices surging to a noteworthy $90 per barrel.

This escalation can be attributed to escalating geopolitical tensions, notably the intensifying conflicts between Israel and Gaza, which has far-reaching implications for the world’s energy sector.

Crude Prices Rushed to US$90 on Escalating Tensions in Middle East

Escalating turmoil between Israel and Gaza ramped up concerns of supply disruptions among key producers in the Middle East. Additionally, U.S. military forces in Iraq were targeted in two separate drone attacks further intensifying market sentiment. Both WIT and Brent have emerged at the $90 per barrel mark, a significant technical threshold.

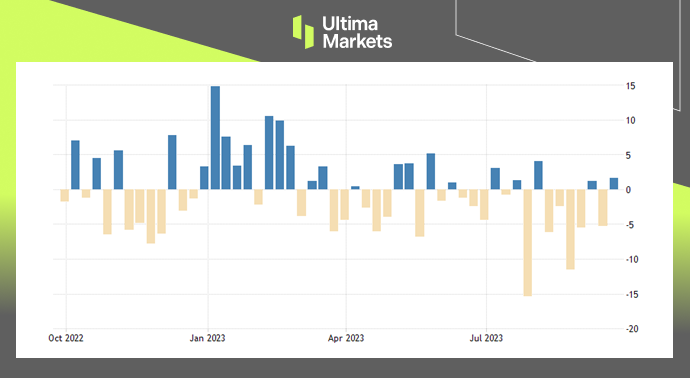

(Brent Crude One-year Chart)

(WIT Crude One-year Chart)

Sharp Decrease in Global Oil Reserves

According to the latest International Energy Agency (IEA) report, in August, there was a significant decline in global oil inventories, with a decrease of 63.9 million barrels (mb) observed.

This drop was primarily driven by a massive drawdown of 102.3 mb in crude oil stocks. Initial data indicates that inventories on land continued to decrease in September, but there was a rebound in oil stored on water as exports started to recover.

Inventory Trends

In the OECD countries, industry stocks experienced an unusual decline of 6.5 mb in August, reaching a total of 2,816 mb, which is substantially lower by 105.3 mb compared to the five-year average.

Conclusion

In conclusion, the surge in crude oil prices to $90 per barrel in October 2023 can be primarily attributed to escalating geopolitical uncertainty, particularly in the Middle East.

The tensions between Israel and Gaza, coupled with drone attacks on U.S. military forces in Iraq, have heightened concerns about potential disruptions in the global oil supply chain.

As a result, the energy industry and financial markets are navigating a period of uncertainty, emphasizing the interconnectedness of geopolitics and global energy markets.

We will continue to watch these developments closely, as they have the potential to reshape the oil market landscape in the coming months.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4