You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

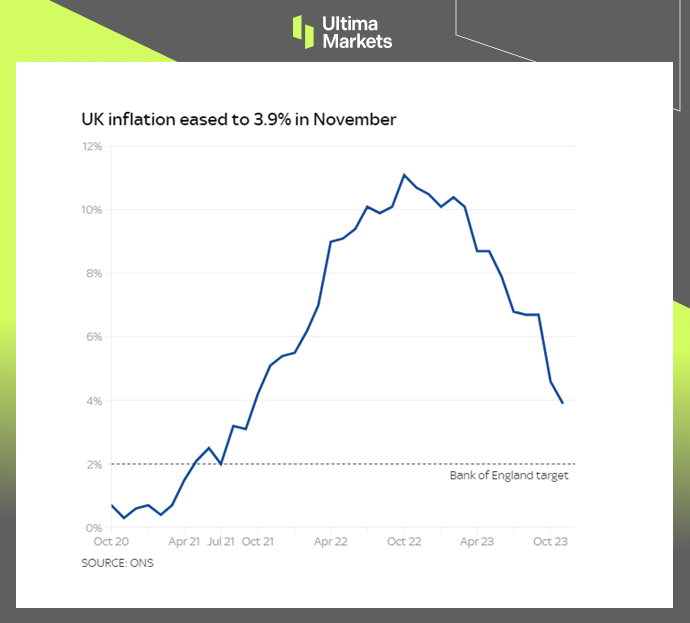

UK Inflation Takes a Dive in November

In a noteworthy turn of events, the UK’s inflation rate took a dip to 3.9% in November, as reported by the Office for National Statistics. This marks a substantial decrease from the 4.6% recorded in the previous month.

The slowdown is attributed to decelerating price hikes in various sectors such as transport, recreation, culture, and food. Notably, fuel prices played a pivotal role in exerting downward pressure on the overall inflation rate.

(UK Inflation Rate)

Factors Driving the Decline

Economists, anticipating a modest decrease to 4.4%, were surprised by the more significant drop. The decline is reflected in various input costs, with raw materials falling by 2.6%, transport costs dropping by 1.4%, and factory gate prices experiencing a slight dip of 0.2%.

Despite this reduction, the inflation rate of 3.9% still exceeds the Bank of England’s target of 2%. Policymakers are cautious about prematurely discussing interest rate cuts, as the hikes implemented earlier this year have already elevated borrowing costs to curb inflation.

Significance of the Numbers

Even though inflation has reached a 2-year low, it remains almost double the Bank of England’s target. Core inflation, which excludes volatile categories like food and energy, has also moderated from 5.7% to 5.1%.

This is a crucial metric monitored by the Monetary Policy Committee when determining interest rates. Notably, the UK’s inflation rate now aligns with that of other G7 economies of similar size, matching France’s rate and surpassing those of Germany and the United States.

UK Chancellor’s Perspective

Chancellor Jeremy Hunt views these data points as indicative of progress in alleviating inflationary pressures. He highlights that this development, combined with the recent business tax cuts, supports healthy and sustainable economic growth.

However, he acknowledges the ongoing challenges faced by many households due to the cost of living crisis. Addressing these challenges remains a priority to ensure the well-being of the population.

Frequently Asked Questions

Q: How much did the inflation rate decrease in November?

A: The inflation rate in the UK decreased to 3.9% in November, down from 4.6% in the previous month.

Q: What are the sectors contributing to the slowdown in inflation?

A: Decelerating price hikes in areas such as transport, recreation, culture, and food, with a significant impact from lower fuel prices.

Q: Does the current inflation rate meet the Bank of England’s target?

A: No, the inflation rate of 3.9% is nearly double the Bank of England’s target of 2%.

Bottom Line

Stay informed with breaking news and in-depth analysis on UK inflation. Explore datasets and statistics on inflation rate provided by Trading Economics. For a comprehensive understanding, use the inflation calculator from the Bank of England.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4