Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

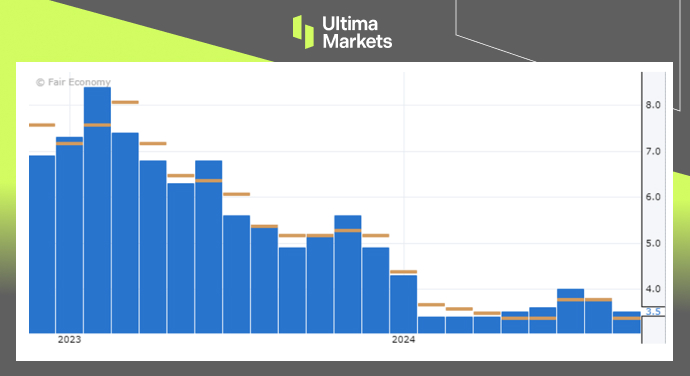

On Wednesday, the AUD/USD pair surged past 0.6800 level, marking its 8-month high. This was mainly due to the year-over-year CPI data rose by 3.5% in July, easing from 3.8% in June and surpassing expectations of 3.4%.

(Australia CPI y/y Data, Source: Forex Factory)

As a result, this stronger-than-anticipated data prompted markets to slightly reduce the likelihood of a rate cut by the Reserve Bank of Australia in November, now estimated at 48.4% compared to 58% prior.

However, the July inflation figures could be somewhat misleading. While the data suggests significant progress in combating inflation, part of the improvement is attributed to rebates that artificially lowered electricity costs.

Tapas Strickland, head of market economics at the National Australia Bank, noted that the July report reveals limited further progress in reducing goods inflation. Despite this, markets are still fully pricing in a rate cut this year, partly due to the Federal Reserve’s near-certain move to ease policy next month, with additional cuts expected in Canada, Europe, and New Zealand.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server