Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

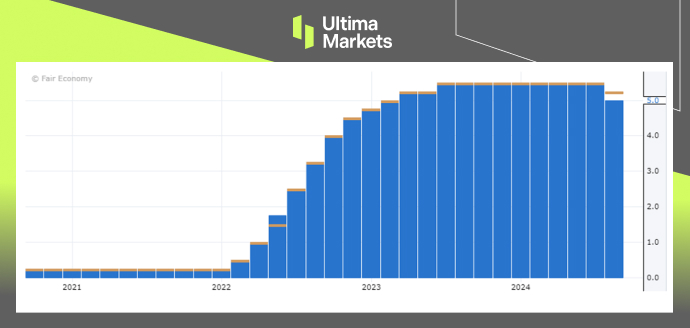

On Wednesday, the Federal Reserve reduced interest rates by 50 basis points to 5%, leading to notable volatility in the U.S. dollar. Initially, the dollar traded lower following the announcement but recovered some of those losses after Chair Jerome Powell’s press conference. Ultimately, the dollar slipped 0.08% after turbulent trading, closing at 100.93.

(U.S Federal funds Rate, Source: Forex Factory)

(U.S Dollar Index Daily Price Chart, Source: Trading View)

During the press conference, Powell emphasized that he doesn’t foresee a recession or economic downturn soon. The Fed’s primary objective is to stabilize inflation while preventing a rise in unemployment rates. Powell also highlighted that the 50 basis-point cut reflects the Fed’s strong commitment to these goals.

Republican presidential candidate Donald Trump remarked on the rate cut, calling it “a big cut” and speculating that such a significant reduction could indicate a very weak economy, unless the Fed was playing politics.

Additionally, policymakers anticipate the Fed’s benchmark rate to drop another half percentage point by year-end, with further reductions totalling 1.5 percentage points by 2026, bringing the rate down to a range of 2.75% to 3.00%.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server