Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

US 4Q23 GDP Revised Higher, Stock Markets Soared in 1Q24

TOPICSUS stocks closed on a mixed note on the final trading day of the first quarter, right before the Easter holiday. The S&P 500 inched up by 0.1% to set a new record, the Dow Jones Industrial Average increased by 47 points (0.12%), while the Nasdaq Composite dipped by 0.1%. This market activity took place as investors were on the lookout for the Federal Reserve’s key inflation metric and comments from Fed Chair Jerome Powell, expected the day after.

Despite a sluggish start to the trading day, the quarter closed with considerable strength in the equity markets, adding $4 trillion to the value of US stocks. The surge has been fueled by comments from Federal Reserve officials hinting at a cautious stance toward reducing interest rates.

For the quarter, the S&P 500 achieved a 10.2% gain, its best first-quarter performance since 2019. The Dow Jones posted a 5.6% gain, representing its strongest first-quarter finish since 2021, and the Nasdaq made significant strides with an 8.6% increase.

(S&P500 Index Six-month Chart)

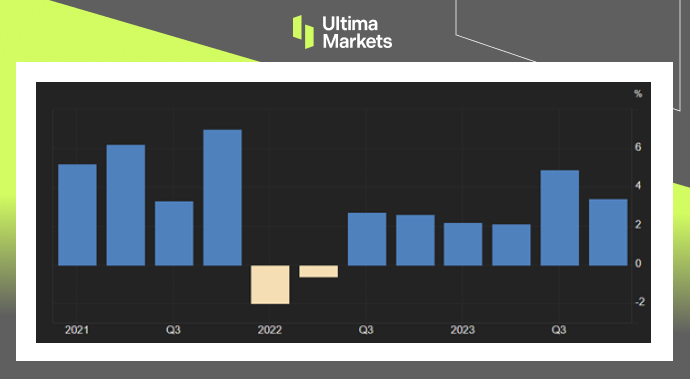

The U.S. economy gained momentum in the fourth quarter of 2023, according to the Commerce Department’s third GDP estimate. The annualized growth rate was revised up to 3.4% from an initial 3.2%, propelled by vigorous consumer spending and higher business investment in structures like factories and healthcare facilities. Thursday’s report also noted a sizable jump in profits for non-financial corporations during 4Q. This confluence of rising profits and enhanced worker productivity could incentivize companies to retain their existing workforce, potentially extending the economic expansion.

(U.S. GDP Growth Rate,Bureau of Economic Analysis)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server