Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

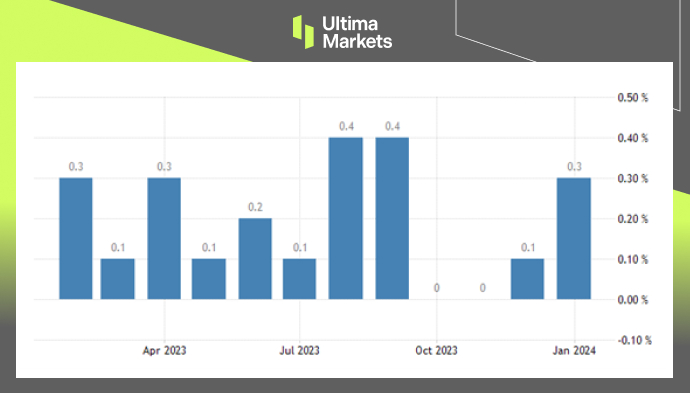

The US recorded a 0.3% growth in its personal consumption expenditure price index in January 2024, conforming to the anticipated market predictions of 0.3%. This marginally increased compared to an adjusted 0.1% surge experienced the previous month, December. Service prices experienced a 0.6% rise while goods showed a 0.2% decrease. The year-on-year growth rate declined to 2.4%, recording the lowest since February 2021, down from 2.6% of the previous month and aligning with the predicted 2.4%.

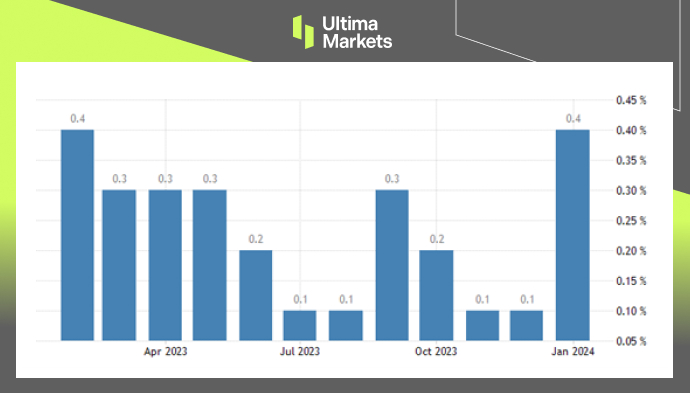

At the same time, the monthly core PCE inflation, which rules out food and energy and is a preferred measure of inflation by the Fed, modestly rose to 0.4%, marking the most significant hike since last February and surpassing an adjusted 0.1% rise seen in December, thus coinciding with predictions. Concurrently, there was a 0.5% surge in food prices and a 1.4% drop in energy prices.

The core services ex housing inflation, rose 3.45% year-over-year and 0.6% month-over-month in January. The Federal Reserve pays close attention to this measure. Both the annual and monthly increases were substantially higher than in recent months, with the 0.6% monthly gain marking the largest rise since March 2022. Every component of the Super Core Personal Consumption Expenditures index accelerated in January, driven mainly by faster inflation in the services sector.

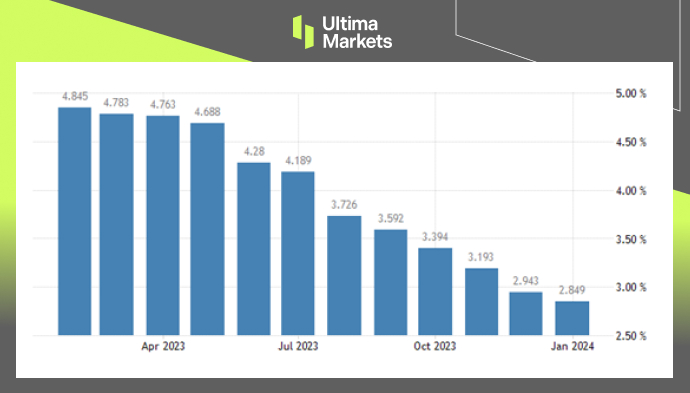

To conclude, the annual core inflation rate saw a reduction for the 12th consecutive month to 2.8% from 2.9%, hitting a new record low since March 2021, and tallying with the anticipated 2.8%.

This is the final PCE report that Federal officials will have access to prior to the monetary policy meeting scheduled for the 19th and 20th of March. The Federal Reserve’s Chairman, Jerome Powell, along with other officials, has essentially dismissed the possibility of a rate cut during this meeting. Consequently, a majority of investors are now shifting their expectations towards June for a likely rate decrease.

(PCE Price Index MoM)

(Core PCE Price Index MoM)

(Core PCE Price Index YoY)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server