You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

9.12 FX Daily GBP/USD

THEMENFocus on GBP/USD today.

Fundamentally, UK is to release its latest August unemployment data on Tuesday. The previous PMI final value data for the manufacturing industry confirmed a downward trend, shrinking for the sixth consecutive month. If the job market shows weakness as well, although inflationary pressure decreases, the outlook for the UK economy may be interpreted as sluggish by the market.

Technically, it can be observed from the weekly chart of the pound that although the random volatility indicator is still in a downward trend, the market is still trapped in the volatility range of the moving average group.

( Weekly chart of GBP/USD, source: Ultima Markets MT4)

The 5-week moving average suppressed the rebound in the exchange rate, while the 33-week and 65-week moving averages supported further downward movements in the market. There is still a possibility of further volatility in the market this week.

(Daily chart of GBP/USD, source: Ultima Markets MT4)

The short forces on the copper daily chart temporarily have the upper hand. The stochastic oscillator crosses downwards. Since the downward trend since early August has been a downward motive wave, there is a certain probability that the recent decline will continue the extended downward trend.

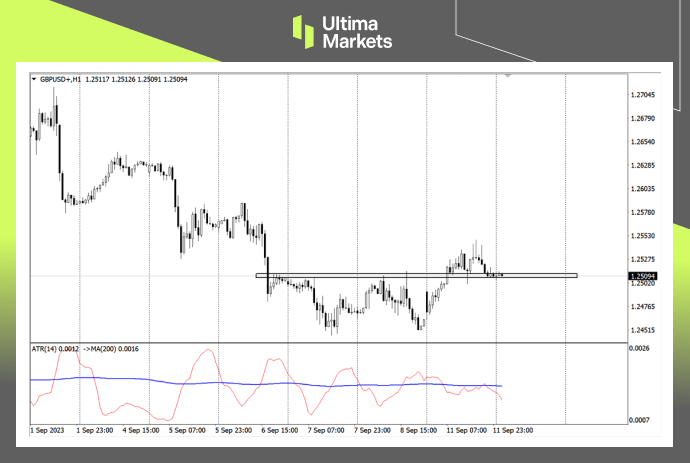

(1-hour chart of GBP/USD, source: Ultima Markets MT4)

On the daily chart, yesterday’s rebound in the market led to a random volatility indicator sending out a bullish signal, but due to yesterday’s K line being only a cross star, the upward momentum of the rebound may be limited. Even if the rebound continues, it is still necessary to conservatively look towards the resistance 1.25675.

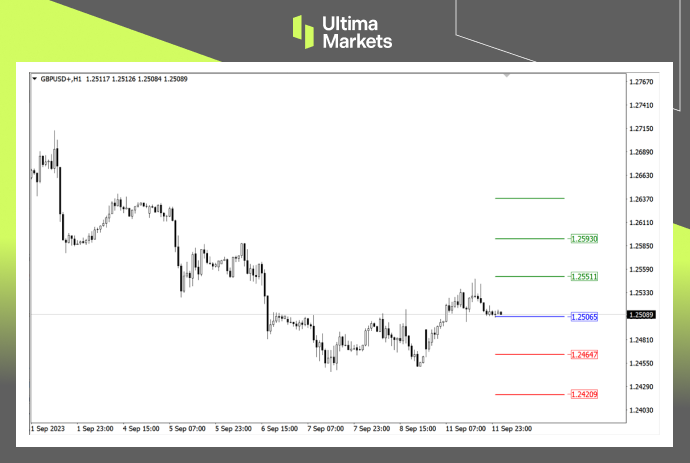

(1-hour chart of GBP/USD, source: Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price on that day is 1.25065,

Bullish above 1.25065, with the first target of 1.25511 and the second target of 1.25930

Bearish below 1.25065, with first target 1.24647 and second target 1.24209

Disclaimer

Comments, news, research, analysis, prices and other information contained in this article can only be regarded as general market information, provided only to help readers understand the market situation, and do not constitute investment advice. Ultima Markets will not be responsible for any loss or loss (including but not limited to any loss of profits) that may arise from the direct or indirect use or reliance on such information.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server