You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Focus on EUR/USD.

Fundamentally speaking, although Fed’s rate hike coming to an end, the U.S. dollar index continues to rise. According to data released by the CFTC last week, the short positions fell to the lowest level in eight weeks. Short-covering is fueling a rebound in the U.S. dollar index as hedge funds continue to trim their short positions.

(US 10 -Year Treasury Yield vs EU 10 -Year Treasury Yield)

During the tightening monetary cycle, the spread of long-term bonds between the United States and Europe drives arbitrage funds to buy dollar and sell euro. In the short term, the spread deliveries adjustments to the exchange rate.

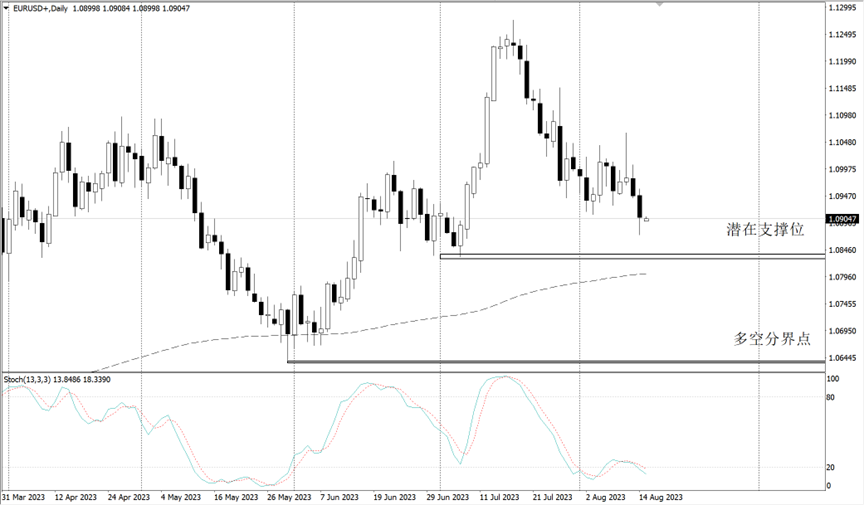

Technically speaking, the EUR/USD daily cycle completed a breakout of last Friday’s low yesterday. The market has a high probability of ushering in a downward trend in the next two days.

(EUR/USD daily cycle, Ultima Markets MT4)

The exchange rate fell below multiple moving averages and was blocked by the 61.8% golden ratio Fibonacci retracement position yesterday. Today there is a certain probability of stepping back on the moving average or consolidating prices, but if today’s market continues to fall below yesterday’s low, the euro will remain weak against the dollar.

(EUR/USD daily cycle, Ultima Markets MT4 )

From the perspective of daily structure, there are two key support positions below the level, 1.0836 is the potential target, and 1.0639 is the extremely critical long-short boundary. If all supportive levels are crushed, a deep correction will come along.

(EUR/USD in 4 -hour cycle, Ultima Markets MT4)

In 4- hour cycle, bull and bear are in entanglement. The Stochastic Oscillator displays a golden cross to indicate the bull, but the exchange rate maintains a downward trend. It means that the decline is not firm enough, and the rebound is still strong.

(EUR/USD in 1- hour cycle, Ultima Markets MT4)

In 1- hour cycle, the price still has the probability of stepping back on the moving average and resistance level. If Stochastic Oscillator shows a dead cross later on, please look for short trading opportunities.

According to the pivot indicator in Ultima Markets MT4, the central price is 1.09147,

Bullish above 1.09147, the first target is 1.09537, and the second target 1.09993.

Bearish below 1.09147, the first target is 1.08680, and the second target 1.08284.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server