You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Better-than-expected Manufacturing PMI Recorded for Germany

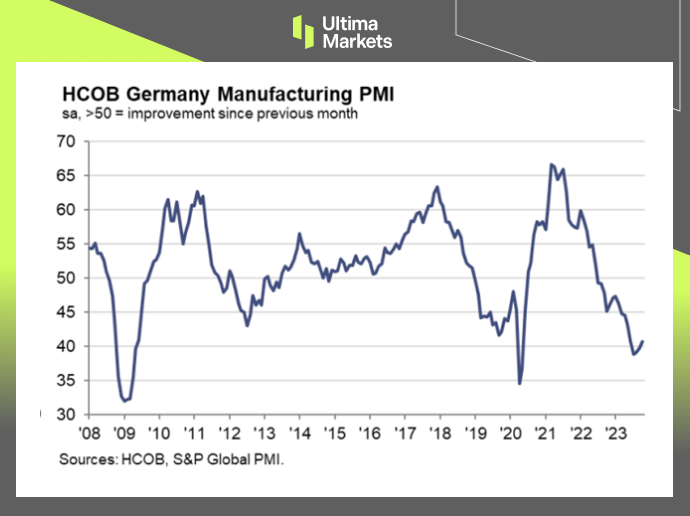

In October 2023, Germany’s manufacturing sector delivered a surprising uptick in performance, marked by the HCOB Flash Germany Manufacturing PMI reaching a 5-month high of 40.7.

This exceeded both expectations and the previous month’s record of 39.6, suggesting a promising turn of events in the German industrial landscape.

While this positive development is noteworthy, it’s essential to understand the broader context of the economic environment and the challenges faced by businesses and labor conditions.

A Ray of Hope in Germany’s Manufacturing

The HCOB Flash Germany’s Manufacturing PMI remarkable rise to 40.7 in October 2023 is a cause for optimism. It’s a significant leap, surpassing the September record and defying expectations. This surge, however, comes with nuances worth exploring.

While the Germany’s manufacturing sector showcased resilience, new orders suffered substantial losses. The decline is evident, reaching its lowest level since June. Additionally, the rate at which companies downsized their workforce in October was the fastest since October 2020.

The pricing front painted a mixed picture: factory gate charges continued their fifth consecutive month of decline, albeit at a slower rate, while manufacturers faced considerable drops in the costs of purchasing materials. Importantly, manufacturers retained a sense of pessimism regarding the future.

These statistics suggest that while manufacturing improved, challenges still persist. The manufacturing sector’s resilience in the face of adversity is a testament to its robust nature, but the decline in new orders and the workforce reduction rate warrant close monitoring.

(HCOB Flash Germany Manufacturing PMI,S&P Global)

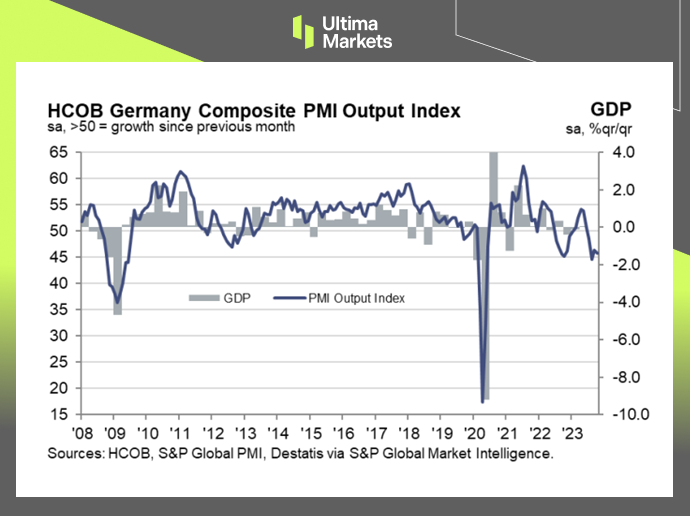

German Composite PMI Displaying Lukewarm Business Activities

In October 2023, the HCOB Germany’s Composite PMI painted a different picture, falling to 45.8, below the previous month’s 46.4 and market expectations of 46.7. This decline points to an overall contraction in economic activity.

Both the service sector, which showed slight improvement the previous month, and Germany’s manufacturing output continued to decrease. Furthermore, the inflow of new business saw its sharpest decline since May 2020, and backlogs of work dwindled.

One significant concern is the rise in unemployment, compared to September, when workforce numbers had declined for the first time in nearly 3 years. On the pricing front, the rate of inflation for output charges remained relatively stable in October, following a low point in September. Regrettably, businesses maintained a low level of confidence in the outlook for the year ahead.

These trends in the Composite PMI are cause for concern. The decline in overall economic activity, the contraction of the service sector, and persistent unemployment challenges paint a less optimistic picture. It’s imperative to closely monitor these trends to gauge the trajectory of Germany’s economy.

(HCOB Flash Germany Composite PMI Output Index, S&P Global)

Conclusion

In conclusion, Germany’s manufacturing sector’s unexpected rebound in October 2023 is a welcome development, demonstrating its resilience in the face of adversity.

However, the decline in new orders, the rapid workforce reduction rate, and ongoing pessimism regarding the future highlight the challenges that persist.

Meanwhile, the Composite PMI figures indicate a broader economic slowdown, with the service sector contracting, unemployment rising, and businesses maintaining a cautious outlook.

As businesses and policymakers navigate these uncertain times, understanding the intricate dynamics of Germany’s economic landscape becomes increasingly crucial. While there are bright spots, acknowledging the challenges and seeking solutions is essential to ensuring a stable and thriving economic future for the country.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4