You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Focus on GBP/AUD today.

On fundamentals, there is no notable financial data due today. The difference in monetary policy between the UK and Australia will control the currency exchange rate in the short run.

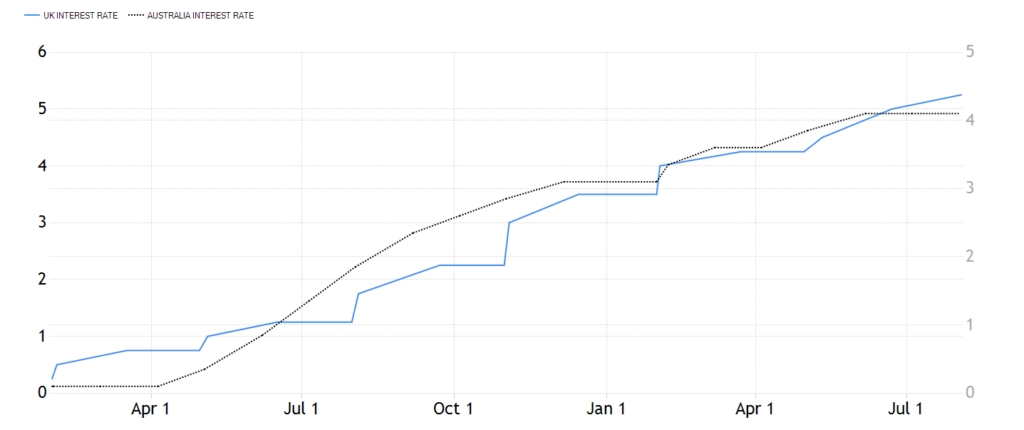

(Blue vs Black, BoE rate vs RBA rate)

The BoE raised its benchmark interest rate by 25 bps to the highest level of 5.25% since 2008. At the same time, the RBA’s is currently set at 4.1%. The interest rate differential means room for arbitrage. AUD is deemed as a commodity currency, inherently vulnerable to commodity prices. The market is positive about RBA rate hikes, resulting in a bullish view of AUD.

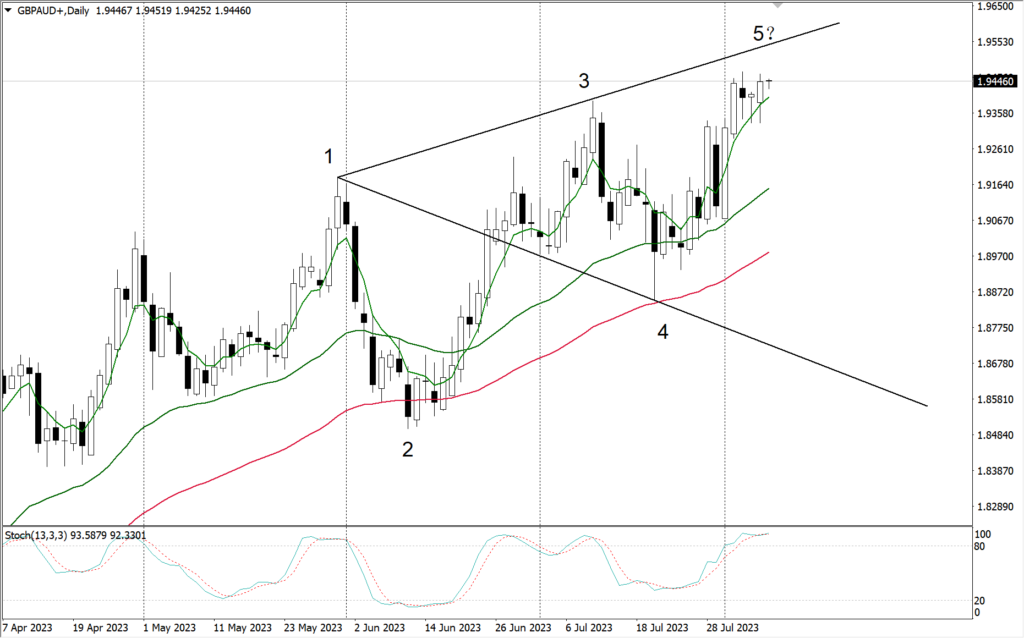

Technically speaking, the GBP/AUD daily cycle structure presents a potential Wolf Wave structure. However, the current price action structure does not show a clear bearish structure.

(GBP/AUD daily cycle, Ultima Markets MT4)

The daily price action has room to rise — support is found on the 33-day moving average. The exchange rate fluctuated on the 5-day moving average for three days and stopped falling with three lower shadows. Still, we need to be alert. The stochastic oscillator has been entangled, and the upper resistance line is not far away. The market may reverse at any time.

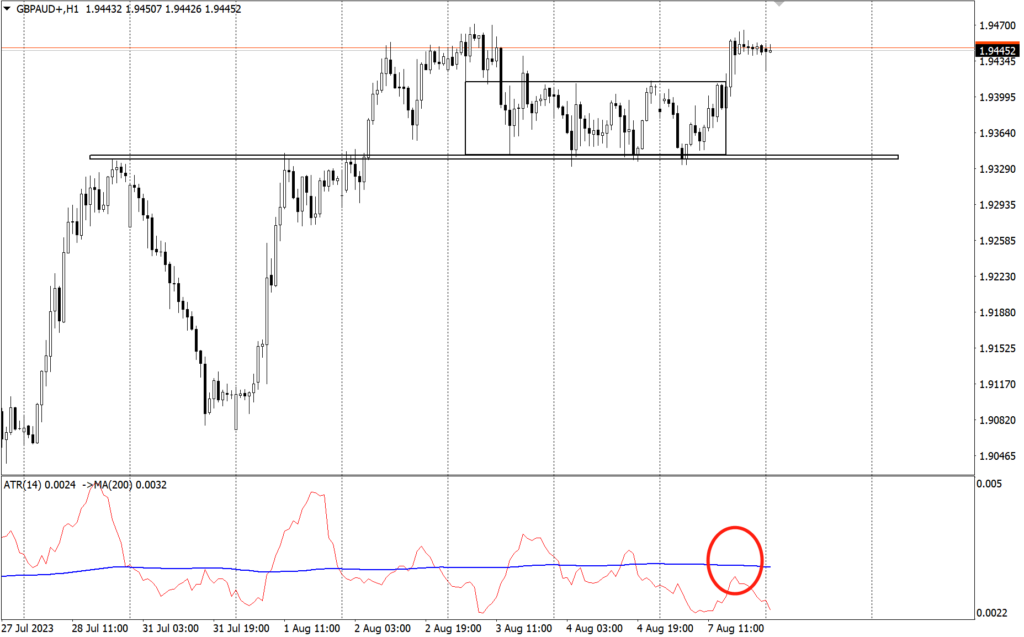

(GBP/AUD 1 -hour cycle, Ultima Markets MT4)

On the hourly chart, GBP/AUD has formed a clear rectangular range after three days of swinging. Yesterday’s breakthrough suggested that bulls are more dominant in the short run. However, judging from the ATR combination indicators, it is doubtful whether the market breakthrough is effective. From a technical standpoint, GBP/AUD looks bullish, however, the sentiment may quickly change.

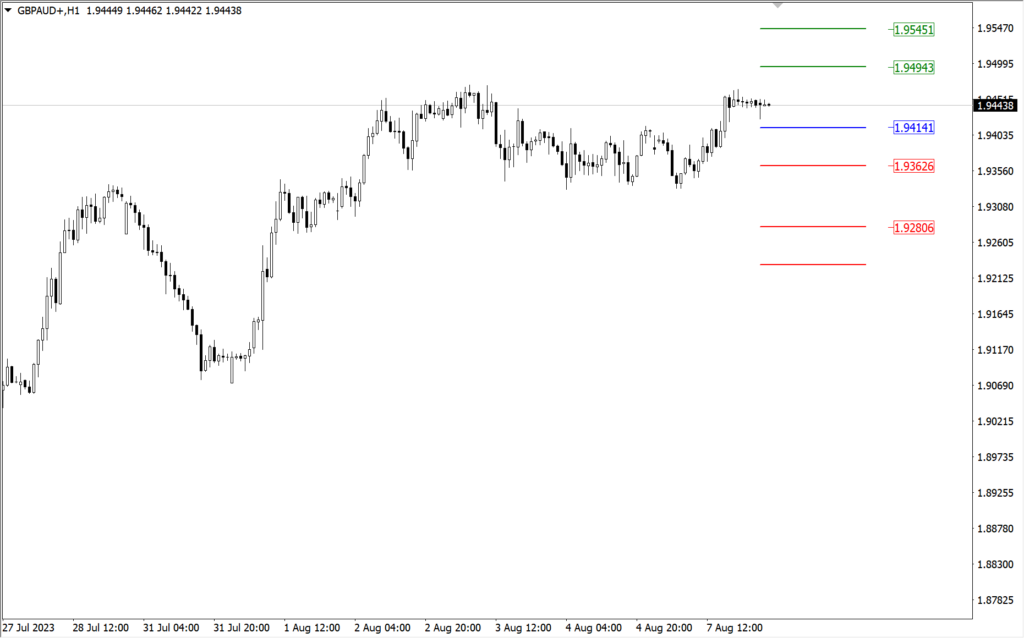

(GBP/AUD 1- hour cycle, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price of the day is 1.94141,

Bullish above 1.94141, the first target is 1.94943, and the second is 1.95451.

Bearish below 1.94141, the first target is 1.93626, and the second is 1.92806.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Mengapa Trading Logam & Komoditas dengan Ultima Markets?

Ultima Markets menyediakan lingkungan trading dengan biaya paling kompetitif untuk komoditas umum di seluruh dunia.

Mulai SekarangPantau Pasar Di mana Saja

Pasar rentan terhadap perubahan penawaran dan permintaan

Menarik bagi investor yang menyukai spekulasi harga

Likuiditas yang dalam dan beragam, tanpa biaya tersembunyi

Tanpa dealing desk dan tanpa requote

Eksekusi cepat melalui server Equinix NY4