You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

The European Central Bank’s Recent Interest Rate Hike and Its Impact on the Euro

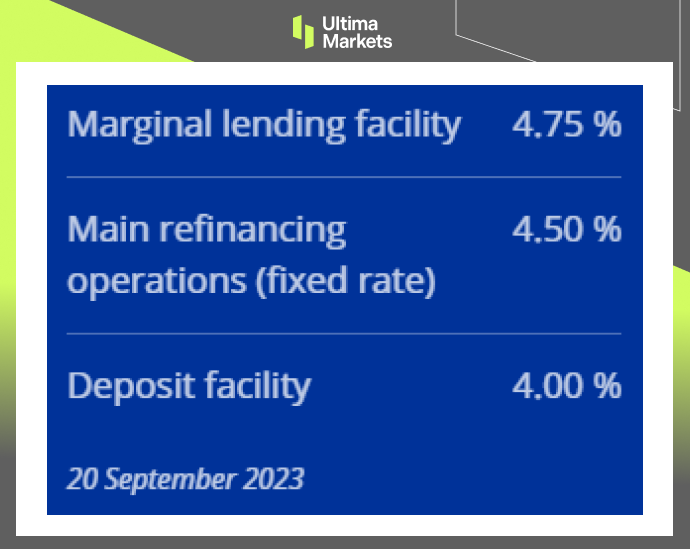

The European Central Bank (ECB) raised the three key interest rates by 25 bps.

Starting from September 20, 2023, the marginal lending facility, main refinancing operations, and deposit facility will increase to 4.75%, 4.50%, and 4.00% respectively, setting a record since the euro was introduced in 1999.

(Latest ECB interest rate, ECB)

A Historic Interest Rate Shift in ECB

The ECB raised the benchmark interest rate from a historical low of -0.5% to the current record high in 20 years and 14 months.

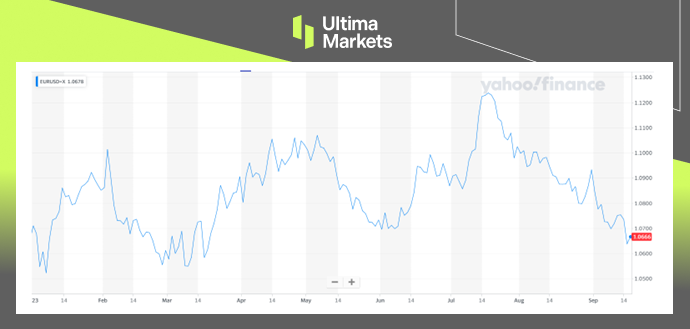

Although Eurozone inflation has cooled, reaching 5.3% in August, the same as in July, it is still far beyond the 2% target. Rising interest rates put pressure on the euro, which fell to its lowest level against the dollar in five months.

(EUR /US YTD Chart)

ECB’s Inflation Control and Economic Growth Prospects

European Central Bank President Christine Lagarde said at the press conference that inflation in the eurozone has been hovering at a high level for too long, core inflation is still too high, and food and energy costs continue to put upward pressure on prices.

She reiterated that the ECB is committed to bringing inflation back to its 2% target. At the same time, the economy is expected to grow by 0.7% this year, 1% next year, and 1.5% in 2025, which is lower than the previous forecast growth of 0.9%, 1.5%, and 1.6%.

The Global Implications

The ECB’s move has not only had a profound impact on the Eurozone but has also sent ripples across the global financial landscape. It underscores the central bank’s unwavering commitment to achieving price stability, even at the expense of economic growth prospects.

In conclusion, the ECB’s decision to raise interest rates to their highest levels in over two decades is a clear signal of its determination to tackle inflation. While this move may have consequences for the Euro and economic growth in the short term, it demonstrates the central bank’s commitment to maintaining price stability in the Eurozone.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4