Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

ECB May Consider Rate Cuts as Inflation Approaches Target

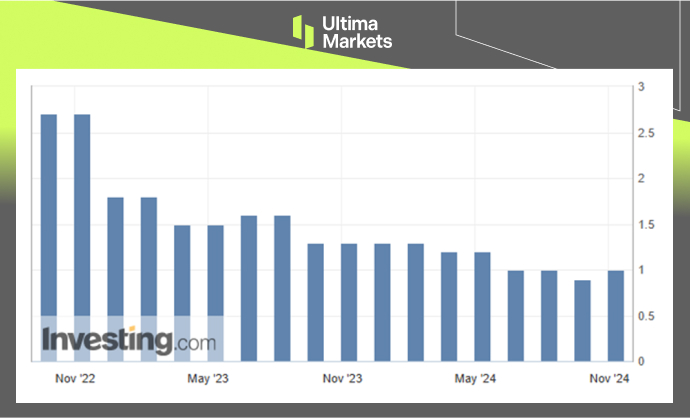

On Tuesday, new data revealed that employment in the 20-member eurozone grew by 0.2% over the previous quarter, twice the pace forecasted in a Reuters poll of economists, raising the annual growth rate to 1.0% from 0.9% three months prior.

(Eurozone Employment Change y/y Chart, Source: Investing.com)

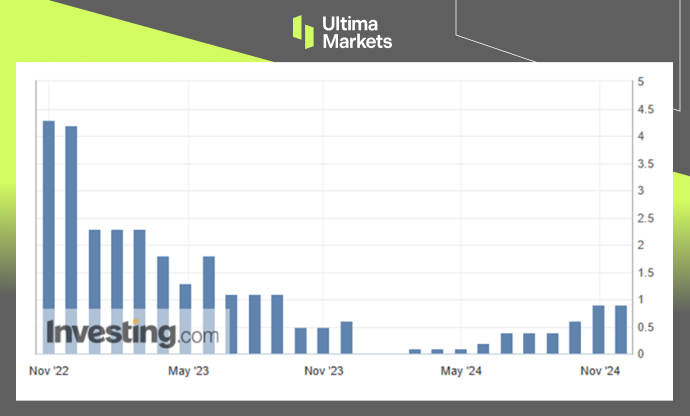

(Eurozone GDP y/y Chart, Source: Investing.com)

While employment growth remains modest, the data may help alleviate concerns that a weakening job market could push the region into a recession, especially given the challenges of weak external demand and a sluggish industrial sector. Notably, the eurozone economy expanded by 0.4% in the third quarter compared to the previous quarter, as reported by Eurostat, confirming its preliminary estimate and surpassing economists’ expectations.

Furthermore, the European Central Bank (ECB) is considering further interest rate cuts as recent eurozone data indicate that inflation is nearing the bank’s 2% target, ECB Vice-President Luis de Guindos stated on Thursday. De Guindos noted that inflation appears to be converging towards the target and aligns with the ECB’s projections.

Additionally, de Guindos acknowledged that while recent inflation data is “encouraging,” broader economic indicators are “less favourable.” Last month, the ECB lowered its main interest rate by 25 basis points to 3.25%, marking its third rate cut this year. Policymakers are now deliberating on the extent of further rate cuts and how best to communicate their approach to investors.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server