Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Gold received high demand in the market, buoyed by imminent rate cut from central banks around the world. The yellow bullion notched in positive gains this week as Federal Reserve, Bank of Canada and European Central Bank is expected to loosen their monetary policy in the coming months.

According to analysts, gold price is expected to set record high this year due to ongoing conflict in Middle East while coupled with lower interest rates. Likewise, traders flock into gold market over fears of US government debt which may worsen due to diminished economic momentum in the recent months.

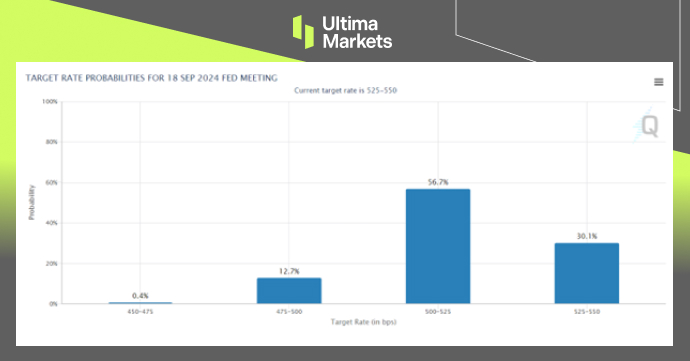

(CME FedWatch Tool, Chicago Mercantile Exchange)

In the meantime, investors are waiting for the release of Nonfarm Payrolls report due later tonight, which is expected to bring further clarification on the timing of rate cuts. Although the central bank is expected to keep interest rates unchanged next week, market is expecting a 69.8% chance for a rate cut by September.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server