You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Focus on USD/JPY

On fundamentals, last Friday, BoJ revealed its monetary policy. The interest rate was unchanged as expected, however, the YCC curve surprised the market. Although BoJ has made a flexible adjustment on YCC, the targeted yield has not floated accordingly. The market describes BoJ as dovish and expects monetary easing policies to exist for some time in the future. In the short term, the yen is still in a depreciation trend while the market taking in the news.

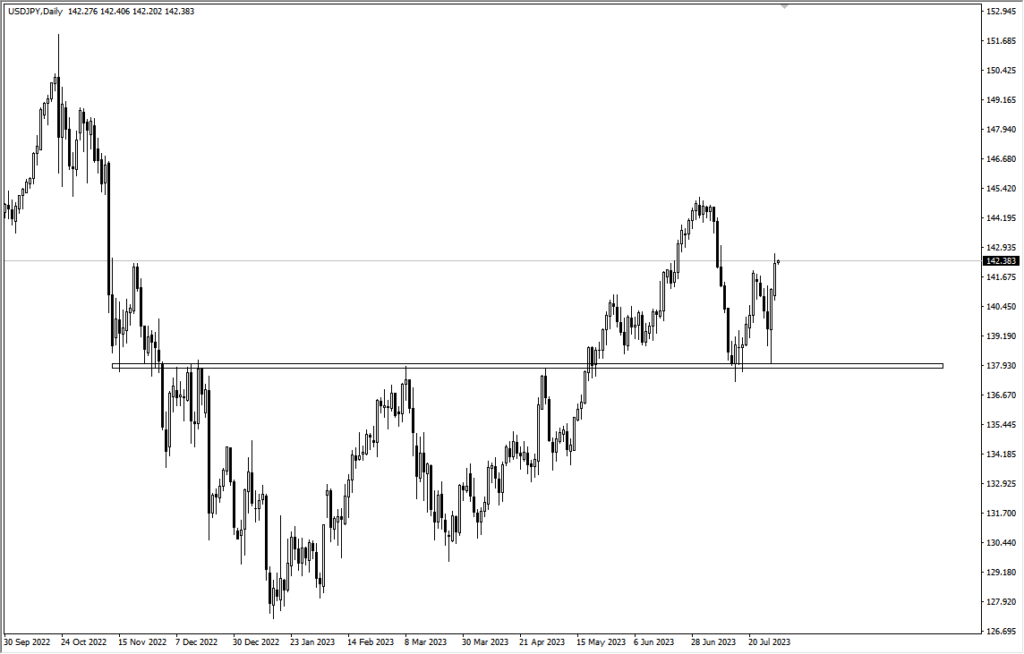

On technical , the USD/JPY daily rebounded at the key support level last Friday, leaving a long lower shadow.

(USD/JPY daily, Ultima Markets MT4)

USD/JPY’s breaking the previous high before the interest rate decision implies a reverse move. Before it hits 144, the probability of extending the downward trend is relatively small.

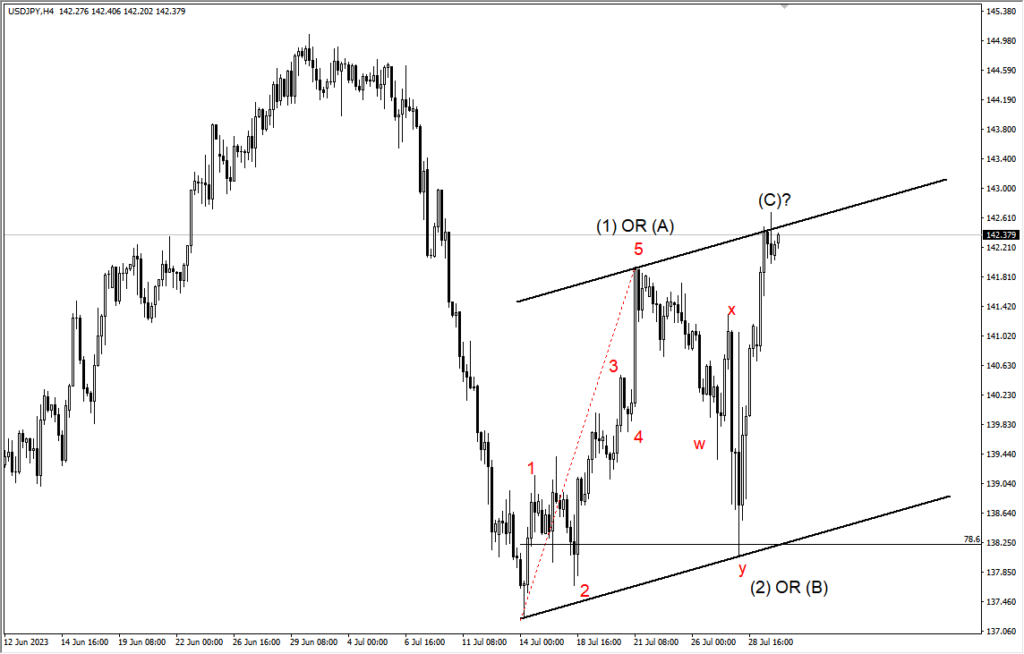

(USD/JPY in 4 -hour period, Ultima Markets MT4)

In 4-hour period, the exchange rate rises to the upper edge of the upward channel. In terms of wave structure, the 5th wave structure can be ensured. It is not yet confirmed that the long-term cycle has made a reversal twist.

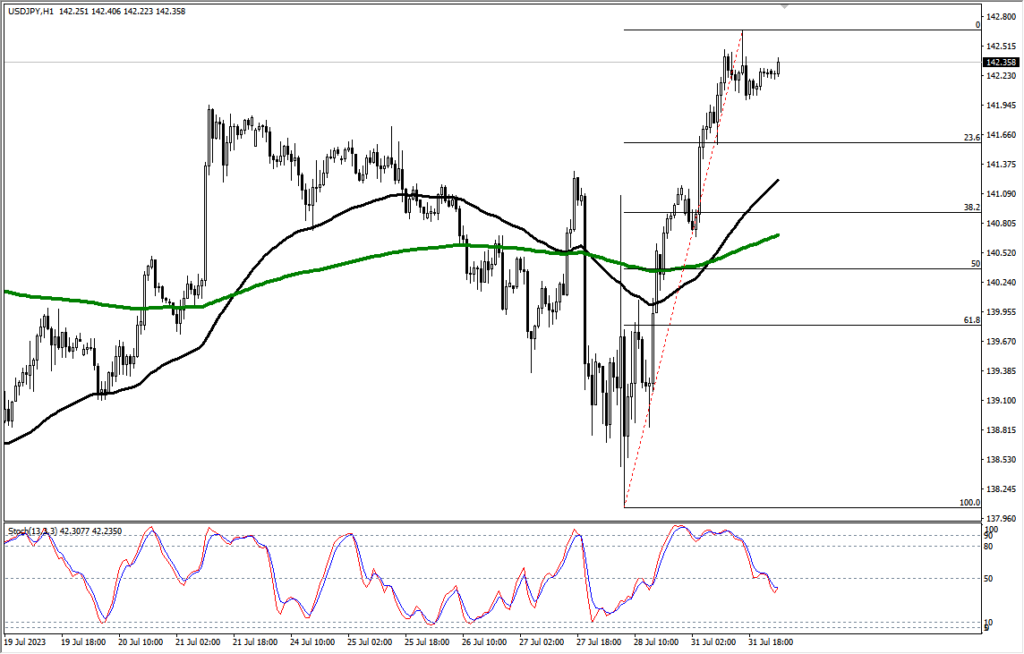

(USD/JPY in 1- hour period, Ultima Markets MT4)

In 1- hour cycle, the 65- week moving average often appeared as a support position in the trend. After the exchange rose and fell back yesterday, adjustment structure emerged. The Stochastic Oscillator was also in a weakening phase. It is expected to find support at the 65 -week moving average or the Fibonacci retracement position around 23.6%.

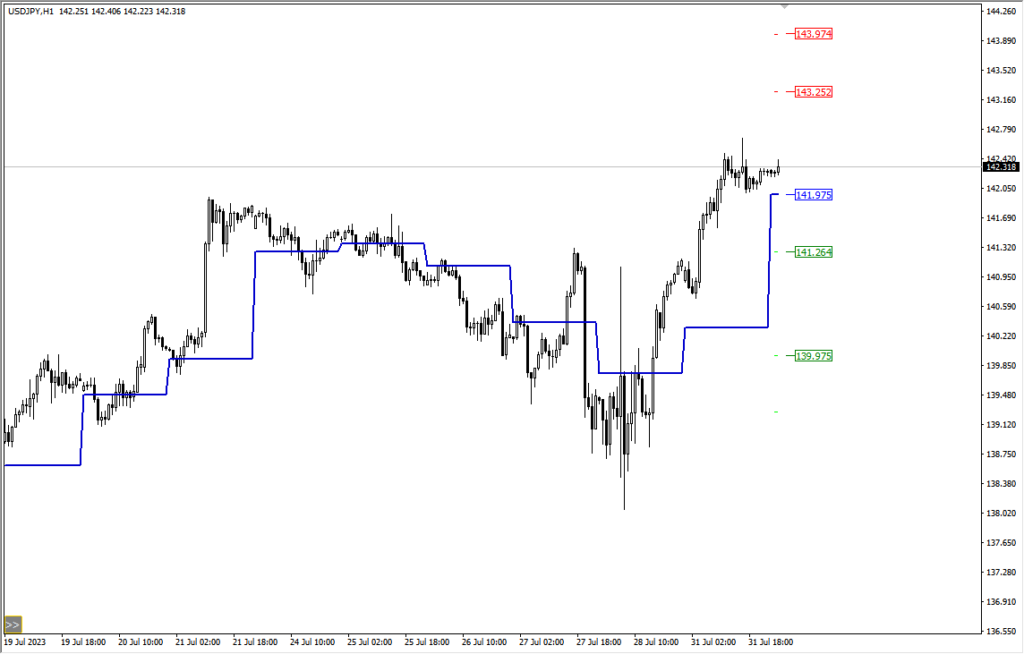

(USD/JPY in 1hr period, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price is 141.975,

Bullish above 141.975 is, the first target is 143.252, and the second target 143.974.

Bearish below 141.975, the first target is 141.264, and the second target 139.975.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Mengapa Berdagang Logam & Komoditi dengan Ultima Markets?

Ultima Markets menyediakan persekitaran kos dan pertukaran yang paling kompetitif untuk komoditi lazim di seluruh dunia.

Mohon sekarangMemantau pasaran secara terus

Pasaran terdedah kepada perubahan dalam penawaran dan permintaan

Menarik kepada pelabur yang hanya berminat dalam spekulasi harga

Kecairan mendalam dan pelbagai tanpa yuran tersembunyi

Tiada dealing desk dan tiada sebut harga semula

Pelaksanaan pantas melalui pelayan Equinix NY4