Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Australian PMI Expansion Continues, Stock Market Poised for Weekly Gains

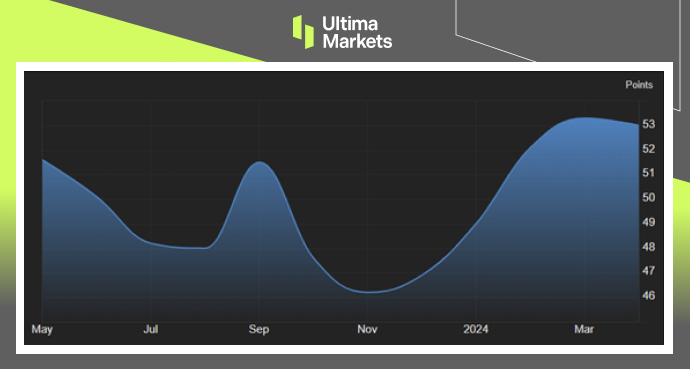

TOPICSIn April 2024, the Judo Bank Australia Composite Output Index dropped marginally to 53 from 53.3 the previous month, as per the final figures. Despite a slight deceleration, the private sector in Australia continued to expand robustly. The increase in business activities was mainly confined to the services industry while manufacturing production kept falling. This pattern was evident in the volume of new orders too.

The overall increase in output and new orders led to higher employment levels in April. Input costs soared at the fastest rate as inflation intensified across both the manufacturing and service sectors. However, overall output price inflation eased. Sentiment in Australia’s private sector remained positive but slightly declined since March. The reduction in service sector optimism offset an improvement in confidence in the goods-producing sector.

(Australia Judo Bank Composite PMI,S&P Global)

On Friday, the S&P/ASX 200 Index climbed 0.5% to surpass 7,600, marking its second consecutive day of increases, following suit with the overnight upswing on Wall Street after the US Federal Reserve dispelled concerns of another interest rate jump.

In local markets, participants will evaluate data on Australian housing loans to determine the real estate market’s robustness. Additionally, investors are anticipating the Reserve Bank of Australia’s policy meeting scheduled for next week, which could provide additional insight into the future direction of domestic interest rates.

Prominent index constituents such as Pilbara Minerals (up 2%), Wesfarmers (up 1.1%), and South32 (up 1.3%) posted significant advances. In business updates, shares of Block Inc. soared 9.7% following its parent company Square’s upgrade of its profit forecast. On the flip side, Macquarie Group’s shares declined 1.6% in response to a 32% decrease in its yearly earnings, with weaker commodity prices impacting its commodities trading arm and a reduction in income from the sale of green energy assets.

(ASX 200 Index Six-month Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server