Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

European Markets Buoyed by Positive Sentiment Despite Bleak Growth Outlook

TOPICSOn Monday, February 19, the European stock markets demonstrated consistency, with the STOXX 50 achieving a new closing high unseen for 23 years, and the more expansive Stoxx 600 reaching a zenith not seen since January 2022. Market participants are looking forward to a noteworthy week with the publishing of important indicators such as the preliminary PMI and the finalized inflation rates of the Eurozone. Additionally, there’s strong anticipation for the release of meetings’ records from both the Federal Reserve and the European Central Bank, along with the financial results from the prominent semiconductor firm, Nvidia Corp.

(STOXX 50 Yearly Chart)

(STOXX 600 Yearly Chart)

The European Commission has announced that the EU economy has stepped into 2024 on shakier ground than previously anticipated, subsequently reducing this year’s growth projection by 0.4 percentage points to a mere 0.8% in the Euro Area. Having just sidestepped a technical recession in the latter half of the preceding year, the projections for Q1 2024 remain modest, according to the 2024 Winter Economic Forecast. Despite the downturn, every nation within the Euro area is positioned for growth in 2024, with expected expansions of 0.3% for Germany, 0.9% for France, and 0.7% for Italy.

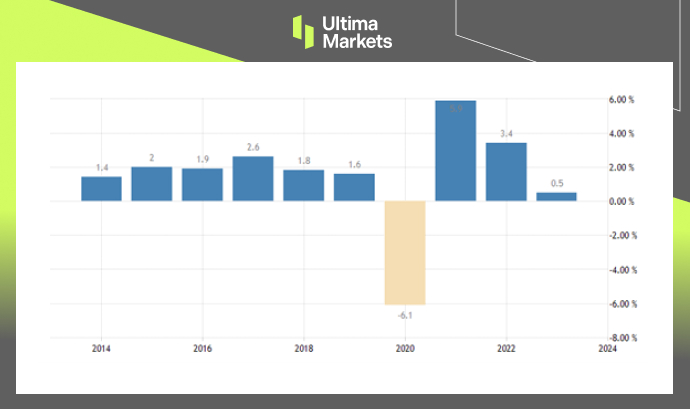

Coinciding with this growth, the inflation prediction has been adjusted downwards from the autumn estimates. The headline inflation is projected to decrease to 2.7% in 2024 from 2022’s 3.2%, dipping to 2.2% by 2025. The steep reduction in energy prices has led to a general and unexpectedly rapid ease in price pressures. As the energy supply exceeds demand, both immediate and future prices for oil, particularly gas, are lower than the assumptions made in the Autumn Forecast. In 2023, the Euro Area economy experienced a growth of 0.5% which is notably less than the 3.4% in 2022.

(Euro Economy GDP Growth)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server