You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

European Stocks: Navigating the Peaks and Valleys

European equities (Stocks) are now a popular choice for investors looking for profitable ventures. Our goal is to disentangle the complexity surrounding key stock indexes, with a particular emphasis on the Stoxx 50 and Stoxx 600, as we delve into the minute nuances.

Stoxx Europe 50 Overview: An In-Depth Analysis

At the forefront of European stock indices, the Stoxx Europe 50 commands attention. This section provides a meticulous examination of its performance, shedding light on recent market movements and offering a nuanced understanding of the factors influencing its near four-month highs.

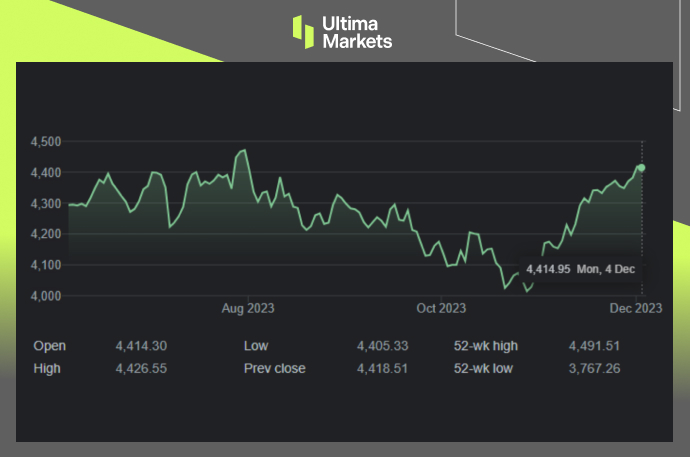

(EURO STOXX 50,Six-month Chart)

Stoxx Europe 600 Index: Decoding the Market Pulse

A companion to the Stoxx Europe 50, the Stoxx Europe 600 Index is a key player in the European stock arena. We explore its role in the market, dissecting the intricacies of its recent fluctuations and the potential impact on investor sentiment.

Corporate Landscape: Roche and AstraZeneca Making Waves

In the dynamic realm of European stocks, corporate maneuvers often dictate market trends. Our focus shifts to two pharmaceutical giants, Roche and AstraZeneca, as they make strategic moves that reverberate across the stock market.

Roche’s Strategic Acquisition of Carmot Therapeutics

Roche, a pharmaceutical powerhouse, recently made headlines with its $2.7 billion acquisition of Carmot Therapeutics. Dive into the details of this deal, exploring how Roche’s foray into obesity drug development positions it against industry leaders like Novo Nordisk and Eli Lilly.

AstraZeneca’s AI-Powered Partnership with Absci

AstraZeneca takes a bold step into the future with its collaboration with Absci, an AI-focused biotech firm. Uncover the potential of this $247 million partnership, as the companies join forces to revolutionize cancer treatment through AI-driven drug discovery.

Market Dynamics: Navigating the Uncertainties

As we navigate the uncertainties of the market, our attention turns to broader economic factors shaping the trajectory of European stocks.

Federal Reserve’s Influence: Awaiting Nonfarm Payrolls Data

Intrigue surrounds the Federal Reserve’s potential influence on European stocks, with investors closely monitoring the upcoming US nonfarm payrolls data. Gain insights into analysts’ expectations and the anticipated impact on the pace of interest rate hikes in 2023.

Frequently Asked Questions

Q: What are the key indices discussed in the article?

A: The article extensively covers the Stoxx Europe 50 and Stoxx Europe 600 indices, providing detailed insights into their recent performances.

Q: Which pharmaceutical companies are highlighted in the corporate section?

A: Roche and AstraZeneca take center stage, with Roche’s acquisition of Carmot Therapeutics and AstraZeneca’s AI-powered partnership with Absci.

Q: What market dynamics are explored in the article?

A: The article delves into the broader economic landscape, with a focus on the Federal Reserve’s potential impact on European stocks.

Bottom Line

In conclusion, this comprehensive overview aims to empower investors with in-depth knowledge, facilitating informed decision-making in the dynamic realm of European stocks. Stay tuned for continuous updates on market trends and corporate developments.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4