You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

The non-farm payrolls have passed, the inflation data has come, and the dollar is still in decline

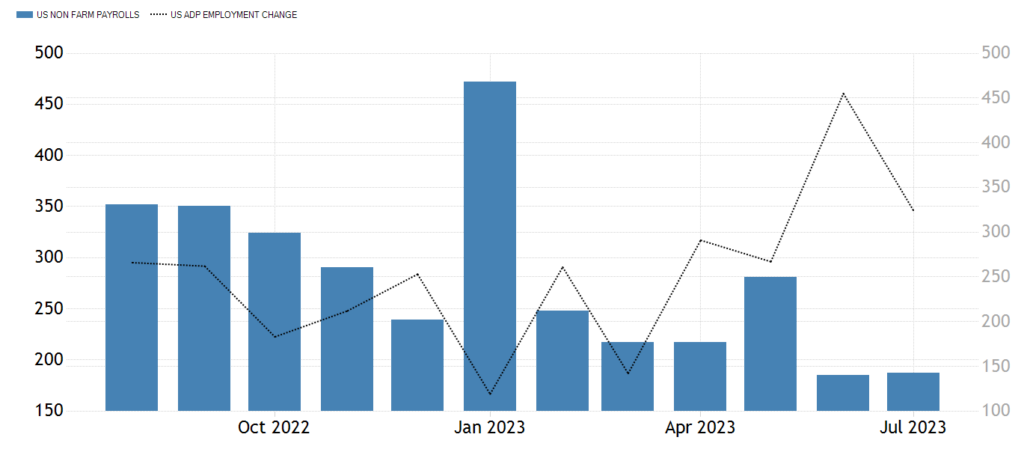

Last Friday, August 4th, the U.S. nonfarm payrolls data fell short of expectations for the second consecutive month. According to the data released by the U.S. Department of Labor, the seasonally adjusted non-agricultural employment in the United States increased by 187,000 in July, the lowest number of new jobs since December 2020, compared with market expectations of 200,000.

Nonfarm Payrolls: A Disappointing Trend

Previously, new job figures for May and June were revised down as well. The May’s number was revised down from 339,000 to 306,000 and the June’s down to 185,000.

It is worth noting that ADP, the identical twin of non-agricultural employment data, also showed a downward trend in August, and this time it did not show the opposite trend to the nonfarm payrolls data.

The divergence in the first two months made the reference value of ADP to decrease.

(Blue column vs black line; non-farm payrolls vs ADP)

Unemployment Rate and Hourly Wages

On the other hand, the unemployment rate eased to 3.5% from 3.6 % in June. In addition, the hourly wage continued to record steady growth in July, increasing by 4.4% year-on-year, beating expectations of 4.2%. The increase in hourly wages may not be what the FED wants to see because of its 2% inflation target.

FED’s Role in the Labor Market

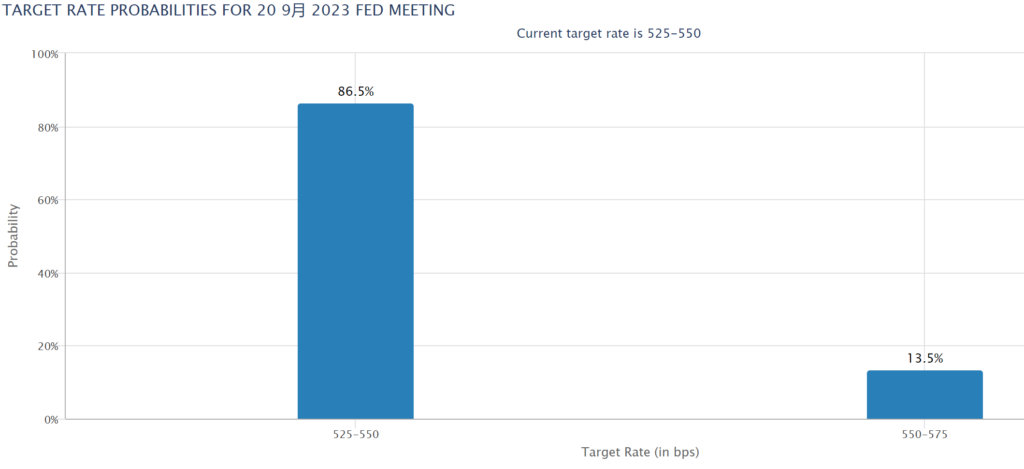

Elon, analyst at Ultima Markets Investment Research Group, said “In general, the FED’s continued tightening policy has begun to take effect in the labor market, and the decline in the number of new jobs for two consecutive months represents the beginning of cooling job market. As a result, the consensus for rate hike in September has not changed significantly.

(The chance that the Fed will not raise interest rates stays at nearly 90%, sourced from the Fed Interest Rate Observation Tool)

Impact on Gold and Non-U.S. Currencies

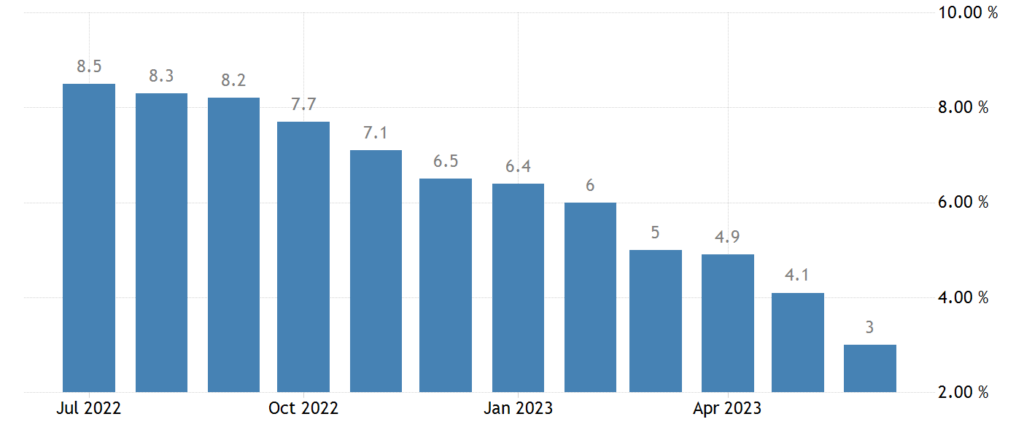

Gold and non-US currencies altogether is happy with the expectation of the Fed’s move to leave interest rates unchanged. It is important to watch out for inflation data this week. Last month, the inflation rate returned to 3%. If the inflation continues cooling, the dollar will go downwards again.

(CPI rates in one year)

Technical Analysis of the Euro

Technically, the euro finds its support on the back of 1.09, rising above the 65-day moving average and the 5-day moving average again. The Stochastic Oscillator is also showing a golden cross gesture, suggesting an underlying bullish trend. If the euro breaks through the peak last week, it will expectedly resume an uptrend.

(Daily chart of EUR/USD, Ultima Markets MT4)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4